4 Tips For Building Your Own Winning Strategy as a Newbie

Building a good strategy is an important - even mandatory - thing that you can do as a day trader. Unfortunately, this is an area where most traders fail in.

Pro traders are also called upon to this challenge, but it can be significantly more arduous for those starting out in trading.

Therefore, in this article, we will explain what a trading strategy is and how new traders can build their own strategies from scratch.

What is a trading strategy?

A trading strategy is a game plan or plan of action that will help you in the financial market. It is simply the process that will guide you when opening and exiting trading positions. In most cases, the strategy will answer several questions such as what, why, when, where, and how.

What

On what, the strategy will guide you to determine the asset that you will be trading in.

This is notable since there are several types of assets in the market like stocks, commodities, cryptocurrencies, and indices among others. But this is not the only 'what' to be answered.

If your idea is to focus on stocks, you must first decide on the sector and then focus on a few companies. The same goes for commodities.

Related » Best Stocks to Trade Today? Find the Most Active Stocks!

Why

Why will give you the reasons you will look at before you open a certain trade. Some of the reasons you can consider when entering a position are a bullish or bearish crossover or a fundamental catalyst.

You should put in place the reasons that need to be met when you are executing a trade. This step is essential: the 'why' is one of the main elements of the trading journal.

When and How

When will give you the ideal time of the day when you will be trading while how will describe how you place trades.

Understanding the best time to enter (or exit) a trade can make the difference between generating profits or losing money, especially for a scalper.

The 'how' is often underestimated. You may think that all you have to do to trade is push a few buttons, but that is not the case. Several market orders can help you avoid problems and better manage your risk.

Taken together, this is what a trading strategy is. If you want to be successful, you cannot afford to leave out any of these points.

So, here are some of the top tips to help you build a strategy.

1 - Find out what works for you

The financial market is extremely broad. And amid this broadness, there is something that can work for you well. Therefore, you should spend a lot of time identifying the key information on what works for you.

For example, you can start by determining the financial asset you will be trading or investing. If you go for forex, you can opt to trade major currency pairs or miners and exotics.

On the other hand, if you opt for stocks, you can select mega-cap companies like Apple and Microsoft. Alternatively, you can go for penny stocks.

Your trading style

In addition, you can find out what works for you in terms of trading or investing. Trading is the process of buying and selling financial assets within a short period while investing is more of a long-term approach. As such, you should focus on either of the two.

Further, in terms of strategy, you should select the approach that works for you. For example, you can decide on whether you want to be a scalper, swing trader, or day trader.

You should spend substantial amount of time determining the strategy that you will will use. Experts recommend that you spend several months determining what works for you. A demo account will be extremely essential as you do this.

2 - Keep it as simple as possible

Another important tip to design a good trading strategy is to keep it as simple as possible. This simply means that you should avoid overcomplicating things.

A common area where many new traders fail is where they overcomplicate things. Because they don't know where to start, newbies put more tools in the chart with this hope: getting better signals.

Focus on few indicators

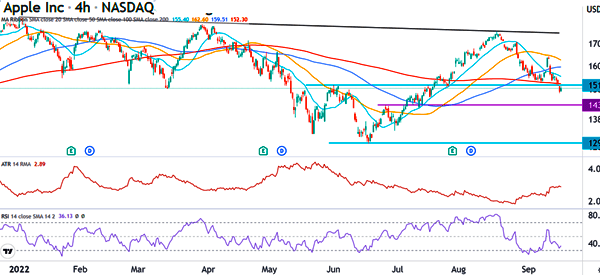

For example, they focus on so many things when doing their chart analysis. In most cases, you will find a beginner trader adding more than 5 technical indicators in a chart as shown below.

This is wrong. Instead, in everything you do, you should ensure that you put everything as simple as possible.

In this case, instead of using many indicators in a chart, you should instead focus on one or two indicators and master them. At DTTW™, we have seen many highly successful traders who have mastered using technical indicators like VWAP and moving averages.

Use chart patterns

Another way you can simplify your trading is to focus on chart patterns alone. Some of the most popular patterns that you can use in trading are:

Triangles Head and shoulders Rising and falling wedges RectanglesFocusing on these patterns will significantly simplify how you trade and make you succeed.

For example, the chart below shows that Apple shares have been in a downward trend and is below the 50-day moving average. Therefore, you can place a sell trade as long as the price is below this moving average. Also, focus on identifying support and resistance levels.

3 - Test different strategies

The next step for coming up with a winning strategy is to test different strategies in the market. Fortunately, most online brokers provide a free demo account that a person can use to create and test their strategies.

Related » Why Practice Day Trading?

A demo account is completely similar to a live account. The only difference is that the account does not have real cash. Instead, it gives you access to all data and tools in the market and lets you trade.

Therefore, as we mentioned above, you should spend at least three months in a demo account testing different strategies and establishing the one that works. For our partners, for example, we have the TMS platform.

At times, you will find that a certain strategy works in different market conditions and others that don’t. Therefore, you should work hard to find an approach that works well.

Related » Day Trading Strategies: 7+ Timeless Approach That Work

4 - Consult

Finally, we recommend that you consult with people who have been in the trading industry for a long time. Doing this will help you use their experience and apply it in your trading practice.

A good way to go about this is to join an established trading floor. This could be a large financial institution like an investment bank or a small office with a few traders. Joining such a trading floor will help you learn from their experience.

Related » How to be a Successful Trader: from Zero to Hero

Summary

In this article, we have looked at the ideal process of being a good trader and some of the top strategies you can use to become a better trader.

We have also focused on the best process to follow when creating a good trading strategy when trading all types of assets.