6 Actionable Momentum Trading Tips New Traders MUST Know

Momentum trading is a common trading strategy where participants seek to benefit when an asset is rising or falling over an extended period.

A good example is what happened during the Covid-19 pandemic as stocks surged as the Federal Reserve lowered interest rates and adopted a quantitative tightening (QT) policy.

In this article, we will explain how momentum trading works and some of the best tips to use even if you are a novice in the trading world.

What is momentum trading?

Momentum trading is an approach where a trader identifies a financial asset that is having momentum and then moves with it.

If a stock is moving upward, the trader can place a buy trade and benefit as the price continues rising. On the other hand, if a stock is falling, the trader will short it and benefit as the price slips.

Momentum trading is similar to trend-following in that the trader hopes to benefit when there is an existing trade. So, here are some of the top trading strategies to use in momentum trading.

Best momentum strategies for newbie

Multi-timeframe analysis

The multi-time frame analysis is an important concept in the financial market. It is a process where a trader conducts analysis on a financial asset based on various timeframes. In most cases, we usually recommend looking at three chart timeframes.

As such, if you are a one-minute trader, you can start by looking at a 10-minute chart followed by a 5-minute chart, and a 1-minute chart.

Similarly, if you are a swing trader, you can look at an hourly chart, 30-minute chart, followed by a 15-minute chart.

The benefit of doing a multi-timeframe analysis is that it will help you identify a trend and support and resistance levels. Most importantly, it will help you identify places to place your stop-loss and take-profit.

Wait for pullbacks and consolidations

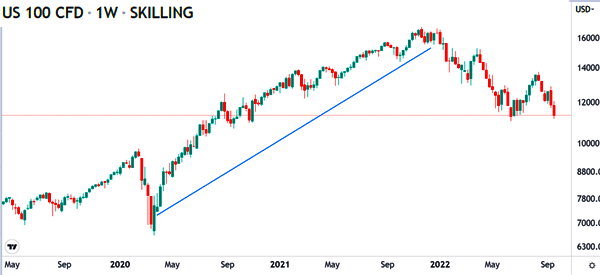

As shown above, a trend in the financial market is never a straight line. In most cases, financial assets will often have some pullbacks and consolidations when they have momentum. Therefore, as a trader, you should always work to identify these pullbacks to enter your positions.

There are several types of patterns that traders can use to identify entry points during momentum trading.

For example, a chart can form a bullish flag or a pennant pattern. A bullish flag happens when a stock consolidates with rectangle pattern while a pennant has a resemblance of a triangle pattern. In most cases, when these patterns happen, they usually have a bullish breakout.

Similarly, a bearish flag and pennant is usually accompanied by a bearish breakout. A good example of a bearish breakout is shown in the chart below.

Focus on catalysts

Another important tip to remember when doing momentum trading is to always look at catalysts that could have an impact on an asset. Fortunately, there are many catalysts that can have an impact on financial assets like stocks and currencies.

In stocks, catalysts can be earnings, management changes, mergers and acquisitions, and corporate events like investor presentations.

A good way to look at this is to use corporate calendars to anticipate stocks that will soon have momentum. For example, you can look at the earnings calendar to see companies that will publish their financial results.

If a company like Meta Platforms is expected to publish earnings, you can expect that it will have a bullish or bearish momentum.

Pre-market movers and most active stocks

Another strategy that will help you with momentum trading is on how to identify companies to trade. With thousands of stocks in the market, using these tools will help you simplify the process. Websites like Investing.com and Market Chameleon have sections dedicated to these sections.

First, you can look at the most active stocks. These are firms that have significant volumes with them. As such, you can do your analysis to find out why they are having momentum.

Second, you can look at top gainers and top losers to identify momentum stocks to trade. Third, you can look for stocks that are reaching their 52-week high and lows.

Always protect your trades

Another momentum trading tip is to always protect your trades. All online exchanges and brokers have tools that make it possible for one to protect their trades.

A stop-loss is a tool that automatically stops trades when they reach a certain level. For example, if you execute a buy trade at $20 and set a stop-loss at $18, the trade will be executed when it drops to that level.

A take-profit, on the other hand, will stop a trade automatically when it hits your profit target. On the other hand, a trailing stop-loss will move with the trade and stop it when it makes a certain loss.

Having these stops will help you protect your account and avoid substantial losses.

Technical indicators

Finally, you should always use technical indicators when day trading using the momentum strategy. For example, you could use trend indicators like moving averages, VWAP, and Bollinger Bands to follow the trend.

In this case, you should always buy when the asset is above the moving averages and hold the bearish trade when it is below the moving averages.

You can also focus on momentum indicators like the Relative Strength Index (RSI), momentum, and MACD to know when to buy or sell a financial asset. All these indicators should be combined with chart pattern analysis.

Final thoughts

Momentum is one of the most important concepts to know and include in your trading activities in the financial markets.

In this article, we have looked at some of the best momentum strategies for beginning traders, yet the insights we have given are also valid for experienced traders.