Stop Placement Strategies! Best Ways to Avoid a Stop Out

Risk management is an important concept in day trading. It is simply the process in which a trader works to maximize their profits while reducing their losses.

One of the most popular risk management strategies is to have a stop-loss or a trailing stop. In this article, we will explain what a stop-loss is and how to prevent being stopped out.

What is a stop-loss?

A stop-loss is a tool that is provided by most online brokers, platforms and exchanges like Coinbase, DTTW, Robinhood, and Schwab among others. It is a risk-management tool that automatically stops a trade once it reaches a certain level.

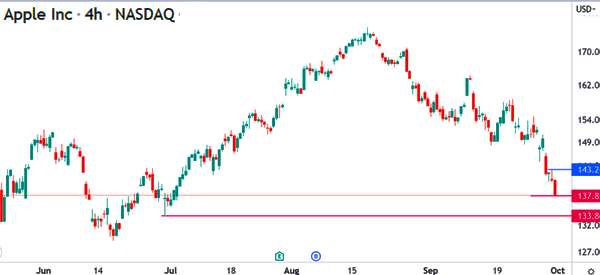

For example, assume that you executed a short trade at $137 as shown below. In this case, your goal is to make money as the stock continues dropping.

As such, your target for profitability can be at $133. At the same time, you can place a stop-loss at $141 to protect your trade if it goes in the opposite direction.

When a stop-loss is executed, you will take a loss but it will protect you from having a bigger loss if the trade goes against you.

Stop-loss vs take-profit

The opposite of a stop-loss is a take-profit. A take-profit is a tool that automatically stops a trade when it reaches a certain profit threshold. For example, in the example above, the take-profit of the trade will be at $133.

As a result, if the stock drops to that level, it will be stopped at a profit. The benefit of a take-profit is that it closes when it hits a target. Most traders set their trades, place their stop-loss and take-profit, and then wait for their trades to develop.

Types of stop-loss

There are two main types of stop-loss in trading. First, there is a basic stop-loss, which is fixed at a certain level. A good example of this is the one we described above. You open the trade and then set a stop-loss at the specific location.

Second, there is a trailing stop-loss. This is a stop-loss that is not fixed at a certain place. Instead, it moves with the asset. This stop-loss solves one of the biggest challenges of a fixed stop-loss. The challenge is where an asset becomes profitable and then makes a sudden U-turn and turns red.

In this case, if it triggers the stop-loss, your initial profit will be wiped out and your trade will close at a loss.

A trailing stop-loss solves this challenge by ensuring that you have captured these profits. As such, if it is triggered, the loss will be equivalent to what you had planned.

How to do a stop placement effectively

A common question among many traders is on the best strategies to place a stop-loss. These traders ask these questions because they are often stopped out. There are several wise strategies to use when placing a stop-loss.

Consider your risk-reward ratio

First, always consider your risk and reward ratio. This is an important ratio that determines the amount of money you are risking compared to what you are getting.

For example, you can decide to have a balanced ratio of 1:1. In this case, for every $50 you plan to lose, you can plan to win $50. In most cases, it is recommended to ensure that you are not risking more than 5% of your total account value.

Avoid this stop out trigger!

Second, don’t place a stop-loss too close to your opening price. This is a common reason why most traders see their trades stopped out.

Ideally, no matter how accurate you are, the trade will always show some volatility before it develops well. As such, if you place a stop-loss too close, it will increase the possibility of it being stopped out.

Analyze more than one timeframe

Third, it is important to look at the key support and resistance levels when placing a stop-loss. One of the best ways is to do a multi-timeframe analysis. This is a process where you conduct a comprehensive analysis based on multiple timeframes.

For example, if you are a one-minute trader, you can start your analysis at the 15-minutes followed by 5-minutes and then 1-minute. The benefit of doing this is that it will help you find the best levels to place this stop-loss.

Analyze from multiple angles

Finally, you should always do a lot of analysis before you do your stop placement. In this, we recommend that you do technical analysis based on indicators like moving averages and the Relative Strength Index (RSI).

This should be accompanied by price action analysis that involves looking at chart and candlestick patterns. Finally, you should do a fundamental analysis, where you aim to look at key themes in the market.

Mistakes to avoid when using a stop-loss

There are three main mistakes you should always avoid when placing a stop-loss in a trade. Some of these mistakes are dangerous because they can cost you a lot of money, but they are not the only ones. Others can make the stop-loss ineffective, invalidating all the work done in the analysis and setting.

Blind configuration

First, you should never place a generic or a trailing stop-loss blindly. This means that you should always conduct your analysis when placing the stop-loss. There should be a reason why you placed the stop-loss at the specific level.

Manually tweak the stop

Second, you should avoid tampering with the stop-loss. This is one of the most common mistakes that people do. It involves changing the stop-loss level when the trade is in the loss-making territory.

For example, if the stop-loss is at $10 and the stock drops to $10.5, you can extend the tool to $9 to prevent being stopped out. This is wrong. Instead, if the trade is making a loss, just let it be stopped out.

Too narrow range

Third, as we have explained above, you should not place a stop-loss too close to the opening price. If you do this, it will increase the possibility of your trade being stopped out.

What does this mean? First, your trade would be stopped immediately, preventing you from making higher returns. Then you would have wasted unnecessary time analyzing the asset and setting the stop-loss.

Summary

In this article, we have looked at the importance of having a stop-loss when trading. We have also looked at the difference between the standard and trailing stop-loss (and why you should use the latter).

Most importantly, we have explained the most common mistakes that we see when people are setting up their stop-loss. And we don't want to make mistakes in setting up one of the most crucial risk management tools, do we?