The True Essence of Being a Consistent Trader (+ Steps)

Consistency is essential in all industries such as finance, education, athletics, and retail. It plays an important role in financial trading and investing.

Over the years, only a small number of traders and investors have managed to achieve consistency. This explains why many hedge funds shutter after six to seven years. And why many traders fails in their trading activities.

However, we want you to be able to generate profits consistently, and we care about your success. In this article, we will look at some of the top tips to use to become a consistent trader.

What does it mean to be a consistent trader?

The financial market is always changing. At times, the market is extremely volatile while in others, it is moving in an upward or downward trend. It usually changes because of various factors like natural disasters, monetary policy, earnings growth or slowdown and geopolitics among others.

What do we mean by "consistent"? Being a consistent trader means being able to make money at types of markets over a long period.

Historically, this has been a bit hard even for legends like Warren Buffett and Paul Tudor Jones. They all go through periods of extreme profitability and others when they make losses.

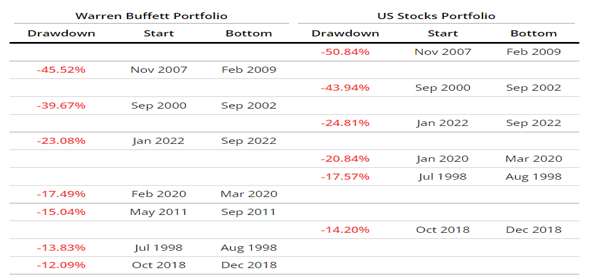

However, in the long term, their returns are usually relatively consistent. For example, Warren Buffett has earned billions by having a compounded annual growth rate of 20%, which is higher than the S&P 500 average of 10%. As shown below, he has had periods of substantial drawdowns.

Benefits

There are several benefits of being a consistent trader or investor. First, it makes it possible for you to create a successful career since you can easily predict your profits and losses.

Second, it is a good way for you to master all market conditions. Finally, being a consistent investor or trader will give you peace of mind.

To be clear. Being a consistently profitable trader does not mean that all your trades are profitable. It means that you are being profitable every month or every year.

Related » When to Start Your Trading Career?

How long will it take you to be a consistently profitable trader?

A common question is how long it takes for a trader to become consistent. The answer to this is that it depends on several factors.

First, it depends on the time that a new trader is spending in their demo account and learning new skills. A trader who spends more time developing a strategy and backtesting it will always take a shorter period to become profitable.

Second, it depends on the skills that the trader has. In most cases, people who are skilled in fields like fundamental analysis and risk management tend to be more consistent faster,

At DTTW, we have been in the trading industry for over two decades. In this period, thousands of traders have passed through our company. On average, it usually takes between 6 to 9 months to become a profitable and consistent trader.

Related » How Much Do Day Traders Make?

How to become a consistent trader

Learn about the market

There are several things to consider when you want to be a consistent trader. First, take time to learn and practice about the market. A common mistake that many new traders do is to open a demo account and execute several trades that become profitable.

After this, they go all in, assuming that they are now excellent traders only for them to lose money within a short period (like a casino player). Therefore, take your time to learn about the market and practice in a demo account.

Have good mentorship

Second, get mentorship from experienced traders and investors. A good thing about DTTW is that we have traders who have been with us for more than 2 decades. These traders are always ready and willing to coach new ones.

Having a good mentor who has been in the game for a long time will help you develop skills for becoming a consistent trader. They will guide you on how to navigate different market conditions and how to avoid making substantial losses.

A good way for you to start is to subscribe to our Trader.tv YouTube channel. It is made up of traders who have been in the game for over 20 years. The channel hosts live trading sessions from Monday to Friday. Subscribing to it will give you all the information you need to become successful.

Trading routine

Further, come up with your trading routine. A routine will help you a great deal become a consistent trader in many ways. A good routine can involve:

having a trading journal analyzing premarket movers having stops for all your tradesamong others.

Discipline

Finally, you should always have good discipline. This means that you should always do several things like having a stop-loss and take-profit for all your trades.

Also, you should ensure that you follow your trading journal, trade what you know well, and always position your trades well.

How to achieve consistent trading profits

There are several strategies you should use to achieve consistent trading profits. First, always have a trading plan. A good plan will tell you when to buy or short an asset. This involves technical and fundamental analysis and price action analysis.

Second, be in a trading office. In most cases, retail traders tend to underperform when they are doing it solo compared to when they are in a trading office. We recommend that you start your trading journey working for a trading floor. As you gain consistency, you can move on and start your own.

Third, always have a good risk management strategy. The one we recommend a lot is always having a stop-loss and a take-profit. When you have a good stop-loss and take-profit strategy, your profits and losses will always be consistent. Further, you should always do position sizing and use leverage well.

Most consistent trading strategy

A common question is on the most consistent trading strategy. There is no single answer to this question. If you asked Warren Buffett, he will tell you that being a long-term investor is the most consistent one.

On the other hand, if you asked a trader like James Simmons, he will make a case that being a trader is better.

Any trading strategy, when used well, can lead to consistency in trading. All you need to do is to design it and test it well.

Summary

From now on, it should be clear why it is important to be a consistent trader. This is true especially if you want to pursue a career in the financial markets.

In this article, we have looked at ways to become a consistent trader. We have looked at what consistency is (remember, this does not mean having only winning trades) and why it matters.

Also, we have assessed whether there is any good strategy that will ensure consistency in your trading.