Stock Trading Strategies for all Market Conditions

Day trading has become popular in the past few years. Millions of retail and institutional traders trade every day. However, the market is always changing as it goes through numerous events.

For example, in 2008, the main theme was the Global Financial Crisis (GFC). In 2020, the main theme in the market was the Covid-19 pandemic.

These are major easy-to-spot events, but market conditions change regularly (without too obvious indications). In this article, we will look at how to strategies for all market seasons.

Find a news catalyst

An important concept that works all the time in day trading is a news catalyst. Stocks tend to react differently when there is a major news event. For example, they tend to rise sharply when there are positive news and then they retreat sharply when there is a negative news.

There are two main types of news catalysts in the market: anticipated and abrupt.

Anticipated catalyst

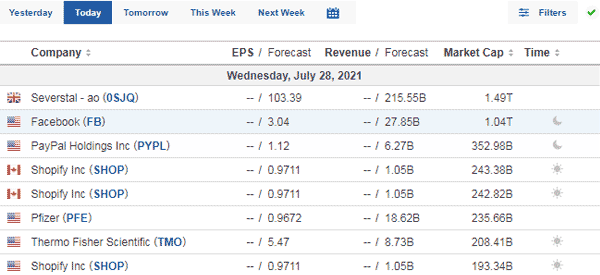

Anticipated news is one that the market is expecting. For example, traders use the earnings calendar to anticipate when companies will publish their quarterly results. The chart below shows how an earnings calendar looks like.

How an earnings calendar looks like (This is from Investing)In addition to an earnings calendar, there are other types of calendars that show anticipated news. Some of these are:

Economic calendar - This is a type of calendar that shows a schedule of economic events that are scheduled to happen. Some of the top examples of events in this calendar are interest rates, inflation, jobs, and retail sales. Dividend calendar - This is a calendar that shows when companies will pay their dividends. Splits calendar - This is a calendar that shows when companies will split their stocks. A split is a period when a company slashes its stock price and adds the number of outstanding shares. The goal is to make the shares more affordable. IPO calendar - This is a calendar that shows companies that are set to go public in a certain period.Abrupted catalyst

The other type of news catalyst is the abrupt one. This type of news is not possible to anticipate. A good example is when Elon Musk tweeted that he would acquire Twitter. While he had already become a shareholder, there is no one who expected the news of an outright acquisition.

Other popular types of abrupt news events are a report by a short-seller, a sudden management change, a merger and acquisition, a new product launch, and segment disposal.

Trading with a news catalyst is a relatively easy thing to do. In most cases, a stock with important news like earnings and M&A will often have more volume.

For an expected news like earnings, you can use pending orders to take advantage on it. For example, if a stock is trading at $10 and it is publishing its earnings after the market closes, you can place a pending order.

In this case, you can place a buy-stop at $11 and a sell-stop at $9 and then protect them.

If the earnings are positive and the stock rises, the buy-stop trade will be triggered. On the other hand, if the earnings are negative, the sell-stop trade will be triggered. This is one of the simplest approaches to use.

Morning gappers

Another strategy to trade in all market conditions is to look at morning gappers. A gap is a situation where a stock opens sharply higher or lower from where it closed the previous day. A good example of such gap is shown in the chart below.

A morning gap happens for several reasons. In most cases, it happens after a major event when the market is closed. For example, macro events like geopolitics can lead to a morning gap. A gap, such as the one shown above, can happen after a company publishes weak results.

So, how do you trade a gap? First, you need to find stocks that are showing significant moves before the market opens.

You can do this easily using tools like Investing.com and WeBull. The chart below shows the pre-market gainers and pre-market losers.

After finding the pre-market gainers, you should work to find out the reasons why they are trading like that. A Google search can easily show you the reasons why stocks are moving in that direction.

There are three main approaches to trade morning gappers. First, based on the reason for the movement, the stock can continue in the direction of the gap. Second, it can consolidate for a while after gapping. Finally, the stock can start a new trend in the opposite direction.

Market sentiment and trend following

Another trading strategy that works at all times is trend-following based on market sentiment. The idea is that traders should focus on the overall market sentiment.

This means buying stocks when things are going on well and shorting when they are not doing well. Doing this will increase your profit potential.

Traders use several approaches to use this strategy. A good one is to use an extremely short-term chart and then combine it with a trend indicator like the VWAP.

For example, a buy trade is triggered when a stock moves above the VWAP indicator. A bearish trend, on the other hand, emerges when it moves below the VWAP, as shown below.

Summary

In this article, we have focused on some of the best strategies that will help you make money in all types of markets.

The idea is that you should focus on companies making some strong market moves and then use indicators to trade.