The Battle for Burgerdom: McDonald’s, Jack in the Box, and Burger King

Three beef-slinging behemoths are about to go toe-to-toe in an all-out brawl for supremacy over the grease-stained domains of Burgerdom.

Opening Moves

McDonald's (MCD) has deployed its long-slumbering anti-hero, the Hamburglar, to introduce its new menu lineup.

Jack in the Box Inc (JACK) aims to flank its fast-food adversaries by way of the Pineapple Express (a new menu lineup).

Burger King (QSR), bruised and twice-bankrupted, is now re-entering the fray armed with... a viral jingle! But at least the once-upon-a-time monarch is backed by a formidable global conglomerate, Restaurant Brands International Inc.

Their first show of strength before their respective campaigns will be in the current earnings seasons, with MCD slated to report on April 25, JACK on May 17, and QSR on May 2. You can assess and compare their fundamental performance and corporate guidance their numbers have been released (and reading their earnings call transcript does help).

For now, let's look at their technical performances to see how they weigh in and size up.

Positional Strengths

Looking at year-to-date performance using StockCharts PerfCharts, JACK is clearly outpacing MCD and the not-so-far-behind laggard QSR.

CHART 1: LEADERS AND LAGGARDS OF BURGERDOM. Jack in the Box is in the lead right now. But another stock may not be far behind.Chart source: StockCharts.com. For illustrative purposes only.

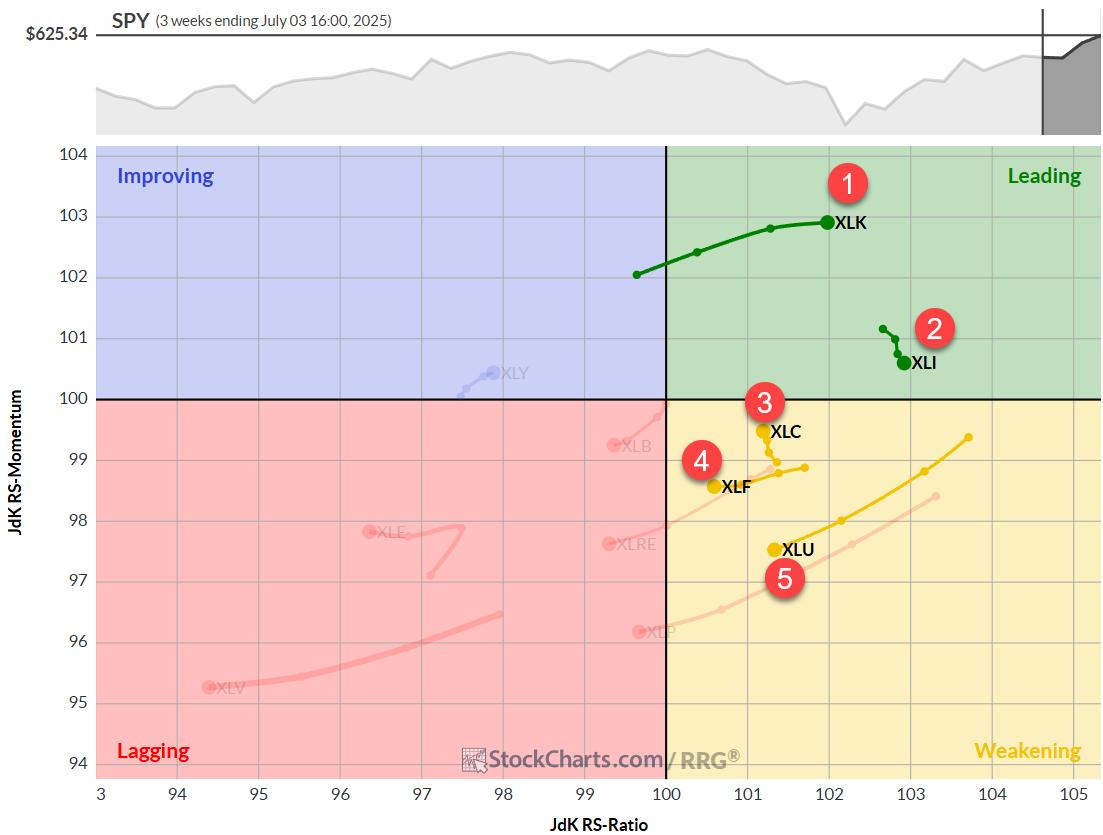

Zooming in for a closer look, you can track the footprints of each stock's weekly performance over a 12-month period using the Relative Rotation Graph (RRG). The RRG chart below reflects the PerfCharts data, but gives insight from a different angle.

While JACK has been sailing smoothly from the Improving to Leading quadrant, MCD rapidly shifted from Lagging directly to Leading, posing a formidable challenge to JACK's leadership. QSR's directionality, on the other hand, seems up in the air, though it appears to be clawing its way out of Weakening ground.

CHART 2: RRG CHARTS OF THE BURGER COMPANIES. The ride from Improving to Leading may have been pretty smooth for Jack in the Box, but McDonald's is rapidly moving from Lagging to Leading. Keep an eye on MCD.Chart source: StockCharts.com. For illustrative purposes only.

McDonald's is in Record-High Territory

Despite lagging JACK over the last 12 months, MCD is the only stock among the three in record-high territory.

CHART 3: MCD STOCK MOVING UPWARD. Watch for a pull back and, depending on price action after the pullback, you can decide if the stock is worth adding to your portfolio.Chart source: StockCharts.com. For illustrative purposes only.

Just a few days ahead of earnings, MCD has broken above its 52-week highs and continues to climb higher. Should the stock pull back post-earning while remaining favorable in Wall Street's eyes, you might expect a pullback to its 50-day SMA (blue line), but it should remain within its current Price Channel (green dotted line). A close below the channel will invalidate the trend (and any possible "long" trades).

Jack's Lead Is Bullish but Problematic

Based on the comparative charts above, JACK is outperforming the other two. But, technically, there are a few problematic signs.

CHART 4: JACK IN THE BOX COULD SPRING HIGHER. It depends on how the stock battles a couple of resistance levels.Chart source: StockCharts.com. For illustrative purposes only.

Unlike MCD, JACK is bouncing back from a 14-month fall from all-time-high territory. It's currently exhibiting an "ugly" Ascending Triangle formation (ugly because it's not entirely cookie-cutter), but with a thick range of resistance above it (the black line sits in the middle of that range). While that's a bullish formation, it's hard to ignore the Death Cross, which took place last September. Still, its earnings are weeks ahead, and it'll be interesting to see what kind of bullish or bearish conviction takes place before it reveals its earnings book.

Burger King Ascending Three Rising Valleys

Burger King is owned by Restaurant Brands International Inc, which also owns Tim Horton's, Popeye's Louisiana Kitchen, and Firehouse Subs.

CHART 5: RESTAURANT BRANDS INTERNATIONAL, THE PARENT COMPANY OF BURGER KING, COULD SEE CONTINUED UPWARD MOVEMENT. The Three Rising Peaks formation of three consecutive higher lows, the stock's close proximity to its 52-week high, and upcoming earnings could help the stock move higher.Chart source: StockCharts.com. For illustrative purposes only.

While QSR has been the laggard of the three over the last two years, its recent moving average action (the 50-day SMA above the 200-day SMA) sits somewhere between indecisive and favorable. However, its Three Rising Peaks formation adds to the bullishness of this scenario. The company is just 5% below its all-time high of $79.46 (September 2019), and its earnings are less than two weeks away. Much depends on its parent company's earnings and guidance overall. Burger King's viral ad campaign may be a hit, but its stock price reflects action across a much broader arena in the fast food theater.

The Decisive Blow

The fast-food giants McDonald's, Jack in the Box, and Burger King are locked in a fierce battle for dominance. As these titans prepare to reveal their earnings and corporate guidance in the coming weeks, their technical performances offer insight into their current standing. JACK's bullish lead is met with some technical concerns, while MCD's impressive record-high territory and QSR's potential resurgence signal that the fight is far from over. Ultimately, the victor in this grease-stained war will hinge on their ability to innovate, engage customers, and deliver consistent growth in a rapidly changing industry. As the battle lines are drawn, investors and fast-food lovers alike will eagerly watch to see which behemoth ultimately claims the throne of Burgerdom supremacy.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.