Big View Slaps Bulls with Warnings

On Monday, after the close, some warning signs from our risk gauges popped up. These are especially interesting given the number of bulls and the amount of money coming into the market.

Technically, we still have the resistance that has not cleared in small caps, retail, or transportation. And this is all happening with a declining dollar, bullish gold, plus renewed buying in agricultural commodities.

Could these warnings reverse? Yes, but this is the most risk-off we have seen as far as the gauges since April.

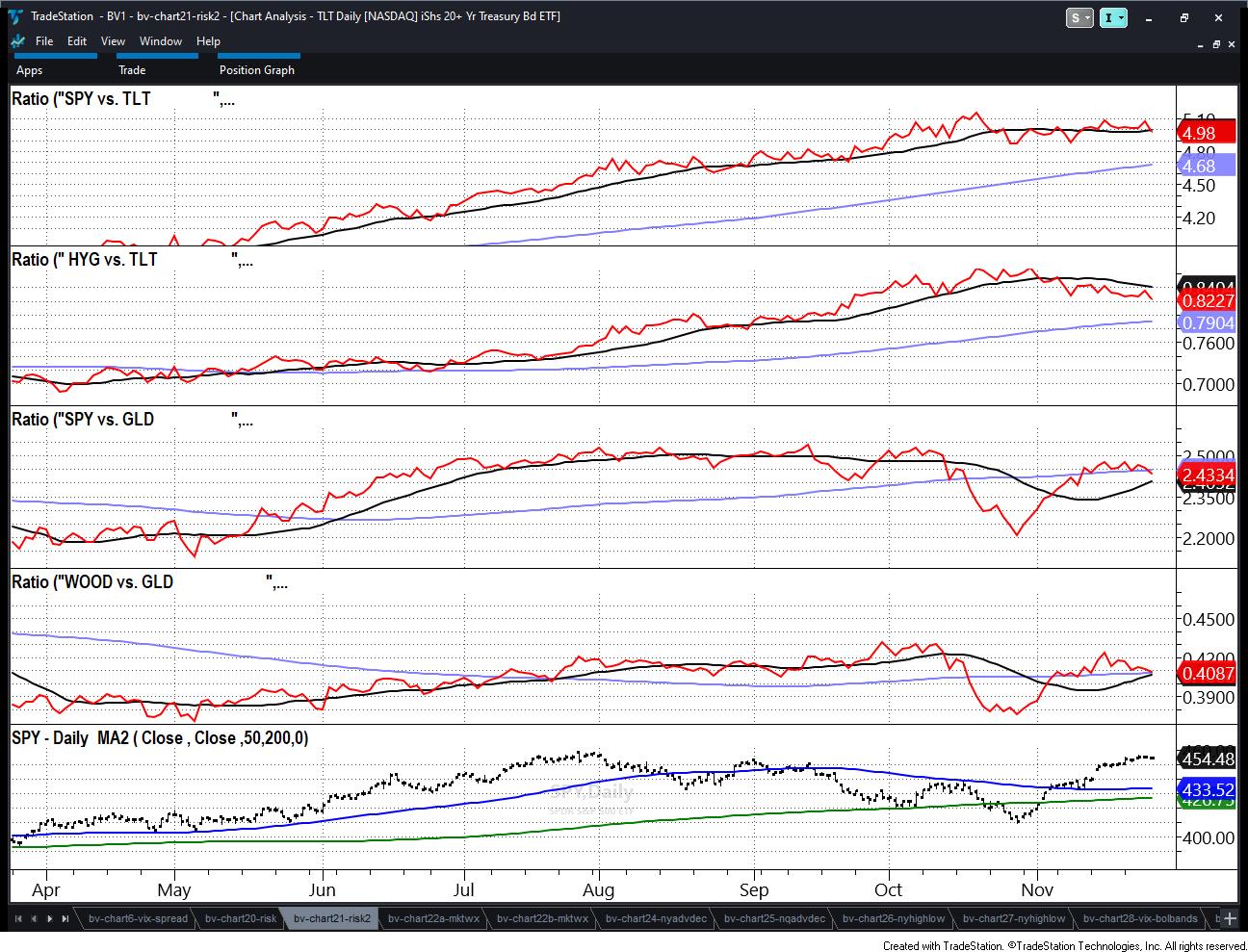

Risk Gauges: WARNINGS

SPY (S&P 500) now on par with TLT (long bonds); you don't want TLT to outperform. Risk off. HYG (junk bonds) underperforming TLT. Risk off. SPY is now underperforming GLD (gold). Risk off. WOOD underperforming GLD. Risk off.Risk off means just that, so pay attention -- these gauges are incredible.

On another note, check out Your Daily Five with 6 picks and setups I did for StockChartsTV.com today!

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

"I grew my money tree and so can you!" - Mish Schneider

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish covers the technical setup for Palo Alto and how MarketGauge's quant models found this winner on Business First AM.

Mish and Maggie Lake cover inflation, technology, commodities and stock picks in this interview with Real Vision.

Mish talks trading range, fundamentals, and how to think about commodities right now on Yahoo! Finance.

In this appearance on BNN Bloomberg, Mish covers the emotional state of oil and gold, plus talks why small caps are the key right now. She also presents a couple of picks!

Learn how to trade commodities better with Mish in this interview with CNBC Asia!

Mish and Charles Payne discuss why the small caps, now in mid range still have a chance to rally in this appearance on Fox Business' Making Money with Charles Payne.

Mish talks about Tencent Music Entertainment on Business First AM.

Mish talks bonds with Charles Payne in this clip from October 27, recorded live in-studio at Fox Business.

Coming Up:

November 29: Crypto Town Hall & Schwab Network

November 30: Live Coaching

December 3-December 13: Money Show Webinar-at-Sea

Weekly: Business First AM, CMC Markets

ETF Summary

S&P 500 (SPY): 450 support, 465 resistance. Russell 2000 (IWM): 181 resistance, 174 support. Dow (DIA): 360 resistance, 346 support. Nasdaq (QQQ): 388 now pivotal support. Regional Banks (KRE): 45 big resistance. Semiconductors (SMH): 160-161 pivotal support. Transportation (IYT): 235 support. Biotechnology (IBB): 120 pivotal. Retail (XRT): 65 resistance and 60 pivotal support.Mish Schneider

MarketGauge.com

Director of Trading Research and Education