Based on Relative Strength, Alphabet (GOOGL) Is An Unloved Stock

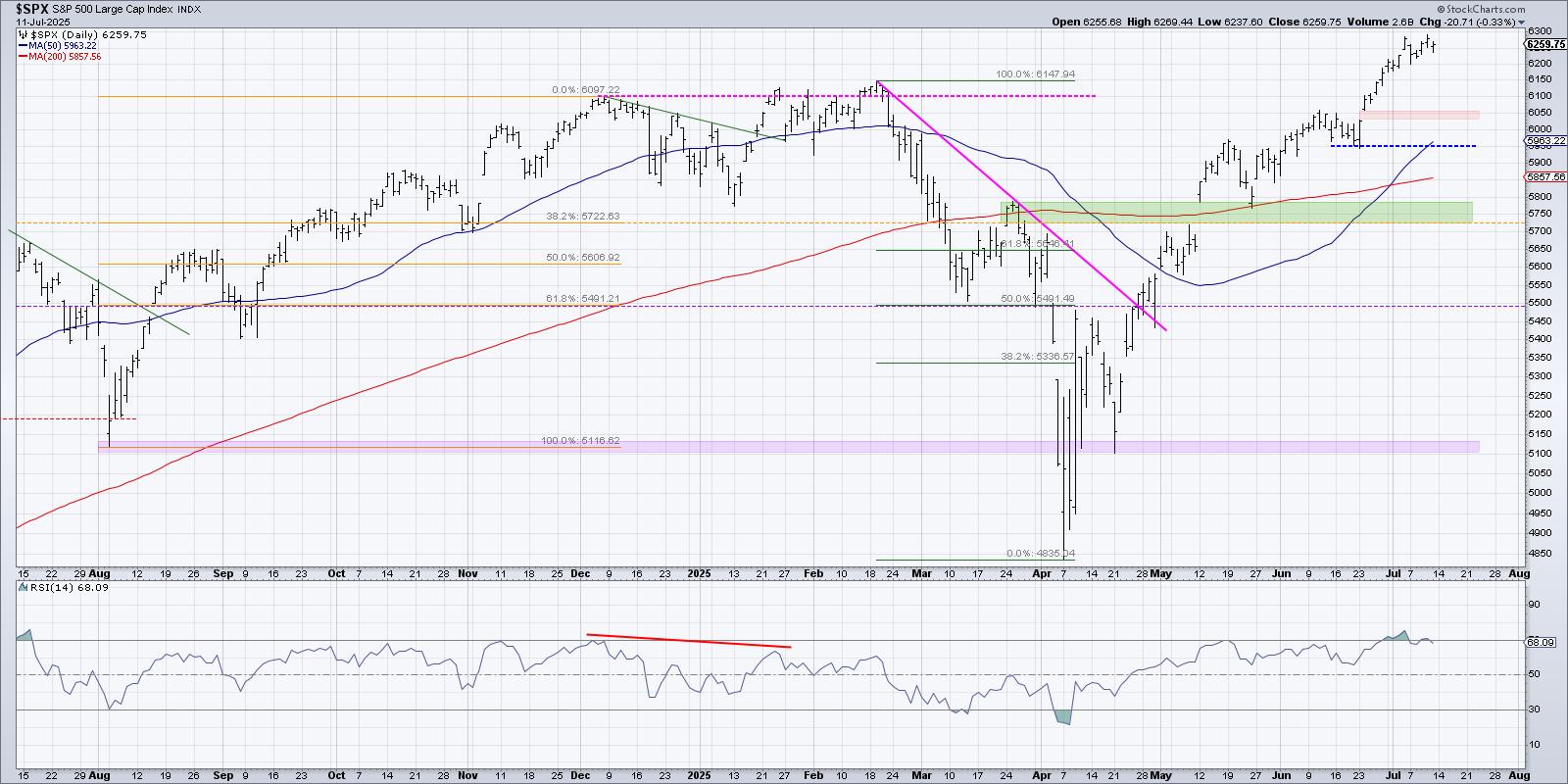

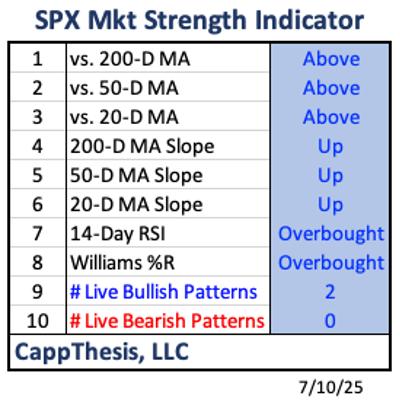

Nearly two weeks ago, I was discussing in our FREE EB Digest newsletter why I felt Alphabet (GOOGL) was poised for a decline after earnings. It was continuing to push higher, which, on the surface, was a fairly bullish signal. However, if you looked at how strong internet stocks ($DJUSNS) were performing as a whole, then it became rather obvious that the big Wall Street firms weren't overly impressed with GOOGL as it head towards its quarterly earnings release. Check out the bottom two panels - the first showing GOOGL:$DJUSNS relative strength and then the second showing the relative strength of Meta Platforms (META) vs. the internet group (META:$DJUSNS):

In our January 26th EB Digest newsletter article, I featured the above trading range (139-144) as a possible landing area for GOOGL after earnings. Heading into its earnings, GOOGL was overbought and was a SIGNIFICANT relative under performer. It's pretty obvious to me that META was leading the internet group, while GOOGL was the beneficiary of being in a strong group. GOOGL's recent weakness did, however, send the stock down into that 139-144 trading range and GOOGL is now testing a longer-term uptrend line. While I'd expect a price bounce from here, it's really relative strength that I'll be watching.

The more leading stocks in leading industry groups that we own, the better our portfolios are likely to perform.

In our Monday morning FREE EB Digest newsletter, I'll be featuring a stock that is setting up potentially for a BIG move higher - at least based on the way it's been trading, relative to its peer group. You can REGISTER for our FREE newsletter with your name and email address. There is no credit card required and you may unsubscribe at any time.

Happy trading!

Tom