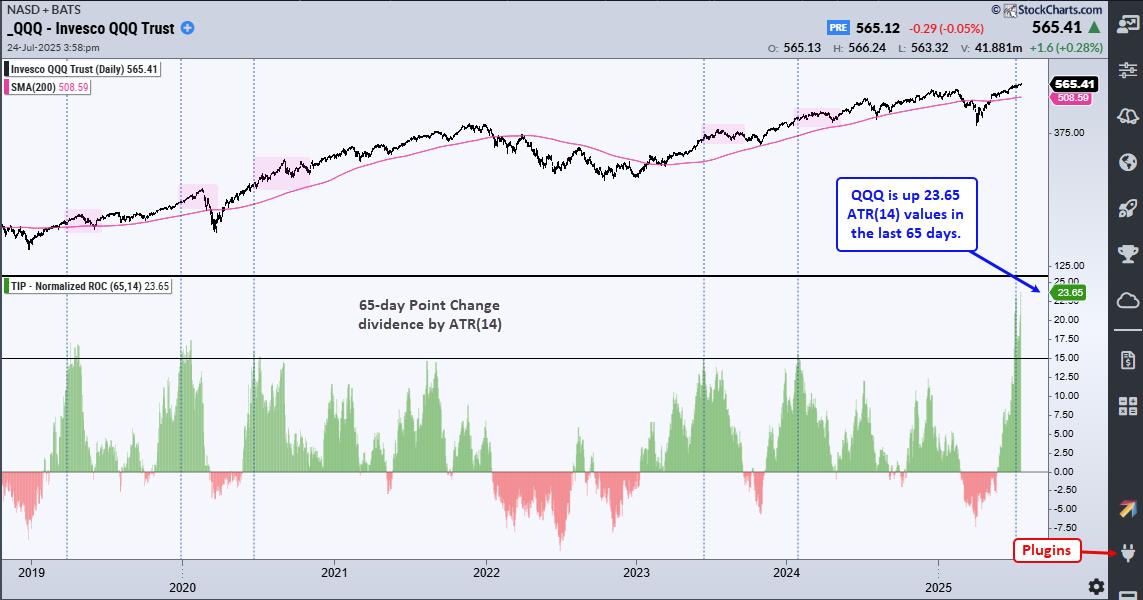

At the Edge of Chaos: Has the Game Changed? Possible Buy Signal for Stocks Emerges

Bearish stock traders are suddenly in a tough spot as major technical indicators flash potential buy signals. In addition, liquidity has stabilized, and money flows have suddenly turned positive for stocks. This combination of factors suggests that this rally has the potential to be a game changer. Get the full details below.

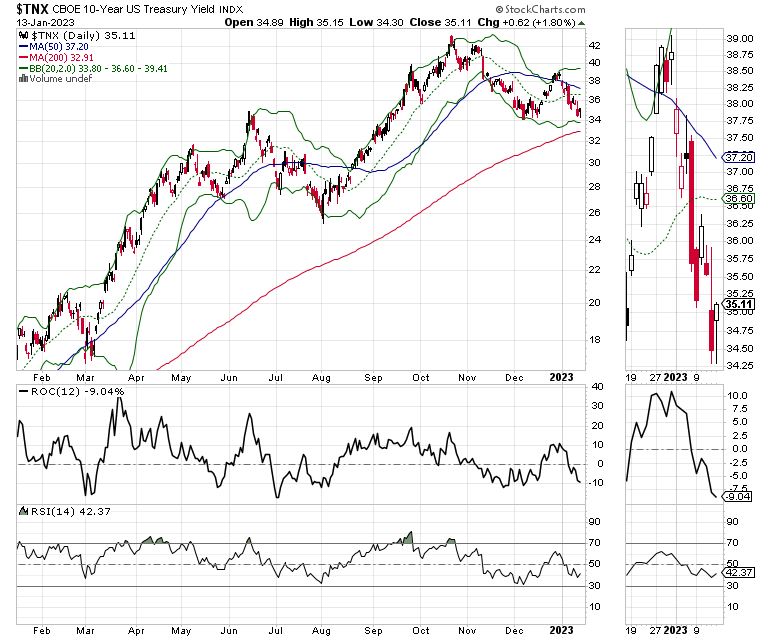

The December CPI was good enough to make stocks jump and bond yields fall precipitously, as the new consensus is that the Federal Reserve will raise interest rates by 25 basis points on February 1, and that it may be its last rate hike. We'll see what happens when the Fed actually makes its next move.

The U.S. Ten Year Note yield (TNX) broke below the crucial 3.5% support level, temporarily, and the S&P 500 (SPX) and the New York Stock Exchange Advance Decline line (NYAD) both moved above their respective 200-day moving averages. Get more details on both below.

When taken together, unless there is a meaningful reversal in the not-too-distant future, these indicators are close to flashing an all-out buy signal, which, if it materializes, could mean that this bear market may be over. Of course, that remains to be seen. We've been here before twice already in this bear market (the summer rally and the failed Santa Rally), but maybe the third time will be a charm.

Last week, in this space, I noted, "Bond yields are well off of their recent highs. That's because there is a growing body of private macro data, especially recent PMI and ISM numbers, that suggest that the U.S. economy has been slowing for months and that perhaps that slowing is accelerating." Specifically, data inside those surveys pointed to a slowing in inflation as well as a slowing in the job market. On the other hand, the December jobs report was not overtly bearish, unless you consider that the ratio of full-time-to-part-time workers continues to suggest that many Americans are either solely working part-time or supplementing their main employment via a second job.

That said, perhaps the silver lining is the slowing in wages, which may be the indicator that gives the Fed wiggle room to slow the pace of its interest rate increases or stop altogether. And that may be good enough for now to push stocks higher.

Bullish Developments: Yes. Total Bullishness: Not Yet.

For the past several months, in my weekly portfolio update to subscribers, I've noted that, when the following conditions are met, I would turn bullish. Here they are:

The NYAD needs to move well above its 200-day moving average; There needs to be a rally in XED, which would mean liquidity has improved; VIX must trade near its lows for a long time, which would mean that put buyers have mostly gone away, leaving the market makers no choice but to buy calls and index futures in order to hedge their bets; There must be clear sign from the Fed that the interest rate hike cycle is not just slowing, but coming to an end.So here is where we stand at the moment. NYAD and VIX have made positive moves. XED is moving sideways, which is better than falling. And the Fed is hinting that it's going to slow its rate hikes, but has not signaled the end yet.

Putting it all together, the environment for stocks has improved, but is not totally calling for an all-out bullish stance. What that means is that sticking with what's working is the way to make money in this market.

Check out what's working with a Free trial to my service. Click here for more.

Expect Buyer Frenzy as Mortgage Rates Resume Down Trend

It's time to watch the housing market, including both existing homes and homebuilder data over the next couple of weeks. That's because a good enough CPI, plus the precipitous drop in bond yields, has reshaped the entire forward-looking interest rate structure.

That means that any potential buyer who has been waiting for a drop in rates might decide that their opportunity has arrived. And if I'm right, the rush to close will be fairly aggressive, as buyers will put plans to work in fear of a rate reversal, which could certainly materialize.

The market is certainly betting on this, as shares of online realtor Redfin (RDFN), whose stock was recently trading under $5 (making it a penny stock), moved decidedly higher on the CPI news. Moreover, bottom fishers had been moving in over the past few weeks, correctly anticipating some type of good news.

On the other hand, the resurgent D.R. Horton (DI), which has been featured in our Rainy Day Portfolio for several months continues its steady climb.

I own shares in DHI.

The Fed's Got a Fine Line to Walk

Familiar readers know that I've focused on the population shift to the sunbelt over the last year as a dominant macro trend. In fact, this is likely the most important economic issue of the moment. And it's directly related to both the employment and CPI data in the future.

That's because, even though the rate of rise in CPI has flattened out, service inflation and shelter costs remain stubbornly high. This is important because there is low housing supply and a potentially tight job market in the sunbelt, which sets up the potential for those two categories of CPI to remain higher than others, which in turn could skew the data in a way that it pushes the Fed to indeed "keep rates higher for longer."

Now, since the housing sector accounts for some 16% of GDP, as the migration picks up speed -- which, based on the suddenly rising numbers of out of state license plates I'm seeing in the Dallas Fort Worth Metroplex (DFW), and hard data, is already well under way -- I am expecting a resurgence in the housing market here before too long. And that means a pickup in not just construction jobs, but also in other areas of employment.

This is due to the fact that more corporations are moving to DFW and other areas of Texas. Apple (AAPL) is expanding its Austin, TX headquarters, while Goldman Sachs (GS) has already quietly moved a large chunk of its operations to Richardson, a suburb of Dallas. Goldman is also planning to move 5000 employees to a new headquarters north of Downtown Dallas, while leasing even more space prior to the construction of its new headquarters. News just broke yesterday that Tesla (TSLA) is expanding its operations in Houston.

If I'm right, based on what I'm seeing at the moment, this activity will work its way beyond just housing data and into GDP. In other words, some areas of the country may face significant economic slowing, but the data may not truly reflect this as the sunbelt's activity more than makes up for the lack thereof elsewhere.

NYAD Breaks Above 200-Day Moving Average

The New York Stock Exchange Advance Decline line (NYAD) broke above its 50-day moving average on 1/6/23 and followed through, breaking above its 200-day moving average a week later. A sustained move above the 200-day average would be a very bullish development.

Note that all counter trend rallies in this bear market have failed at the 200-day moving average. That means that, if this break above this key line holds, the odds of a new bull market will increase.

For its part, the CBOE Volatility Index (VIX) recently made new lows. This is also bullish. When VIX rises, stocks tend to fall, as rising put volume is a sign that market makers are selling stock index futures in order to hedge their put sales to the public. A fall in VIX is bullish, as it means less put option buying.

Liquidity has remained surprisingly stable, despite the Fed's QT maneuvers, as the Eurodollar Index (XED) has been trending sideways to slightly higher for the past few weeks.

The S&P 500 (SPX) found support at 3800 and is now testing its 20-, 50-, and 200-day moving averages, as well as the 4000 area.

But here is the great news. Accumulation/Distribution (ADI) and On Balance Volume (OBV) have both turned up. That means that there is now net buying in stocks.

The Nasdaq 100 index (NDX) continues to lag SPX badly. It is still possible that it may have made a triple bottom, with the 10,500-10,700 price area bringing in some short-covering. The problem is that the 12,000 area and the 200-day moving average, together, form a sizeable resistance band.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition—Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I've made my NYAD-Complexity - Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader, and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best-selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe's exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.