Could Overtrading Really Be a Winning Strategy?

Risk management is an essential part of any trader or investor. It refers to a situation where traders take measures to prevent the downside while working to maximize returns.

There are numerous risk management strategies in the market, including:

Having a stop-loss Checking order sizes Avoiding excessive tradingIn this article, we will focus on overtrading, its risks, and why you should overtrade at times.

What is overtrading?

Overtrading, as the name suggests, is the process of opening too many trades in a single trading session. There is no specific number of daily trades that are characterized as overtrading.

To some people, especially swing traders, opening at least ten trades per day can be seen as overtrading.

To other trader traders, especially scalpers, it is not uncommon for them to open over 50 trades per day. In most cases, the optimal number of trades one should make per day should be less than 20.

Why is overtrading risky?

As mentioned, one of the best approaches to prevent or reduce risks in the market is to avoid overtrading. There are several reasons why overtrading is extremely risky.

Lack of research

First, when you overtrade, there is a possibility that you will not do a lot of research for all your trades. This is dangerous since you will be opening your trades blindly.

And as we have often had the opportunity to say, trading is very much based on analysis (and not on forecasting).

Information overload

Second, overtrading can be tiring and lead to fatigue. This happens when you are doing too many analysis on companies or other assets in a given day. In most cases, this will involve reading multiple news reports, analyst reports, and conducting technical analysis.

Further, managing hundreds of trades in a day can be difficult, especially when the markets are volatile. That’s because the number of news events in the market can be too high, which will make it difficult.

Fees

The other risk is related to trading fees. The benefit of stocks trading in the US is that many brokers have removed fees in a bid to compete with the like of Robinhood and WeBull.

However, if you are trading other markets like forex and options, there is a major risk of spending a lot of money in trading fees.

What causes overtrading?

There are several reasons why people overtrade. First, they overtrade because of their overall strategy. For example, scalpers make money by opening tens of trades per day and then taking a small profit in each of them. Therefore, they overtrade as part of their overall strategy.

Second, traders overtrade because of greed. This happens when a trader has a good winning streak and then assumes that more trades will be profitable.

Further, traders open numerous trades per day because of fear, especially when they have been losing money. The hope is that opening more trades will lead to more profits and help them recoup their losses.

Finally, many new traders overtrade because of their enthusiasm about the market. This happens when they are starting to trade and assume that they will always make money.

Related » The Overconfidence bias explained

When you should overtrade

While overtrading is risky, there are certain times when it makes sense to open more trades than normal. Some of these periods are:

When the market is volatile

While volatility is usually risky for most traders, the reality is that many traders, especially scalpers, find it ideal. That’s because this volatility makes it possible for you to enter trades and close them within a few minutes with a profit.

When the market is trending

The other time when you should consider overtrading is when the market is trending upwards or downwards. Such situations make it possible for traders to open trades and then follow the trends.

For example, if the market is rising sharply, you can open numerous trades following the trend and make money.

When your strategy allows

At times, your trading strategy can allow you to overtrade. A good example of this is when you are using a strategy like arbitrage or pairs trading.

This is a strategy that involves buying and selling assets that are correlated. The goal is to make money from the overall spread that emerges.

How to overtrade well

While we don’t recommend overtrading, there are several strategies that will help you overtrade well. Some of these approaches are:

Do proper analysis

Regardless of your strategy, always ensure that you do proper analysis for your trades. This is where you ensure that you are doing enough analysis before you open a trade.

In other words, always ensure that you have a reason or a catalyst for entering a trade, not just a forecasting.

Always protect your trades

When opening numerous trades per day, always ensure that they are protected. Fortunately, there are tools that help traders protect their trades.

Most companies provide a stop-loss and a take-profit. A stop-loss automatically stops a trade when it reaches a certain level.

Trade sizes

Since we don’t recommend overtrading, we suggest that you always use small trade sizes to reduce your exposition and harmful instincts.

The goal is to ensure that you don’t lose too much money, which is possible when you open too many trades in a day.

Know about correlations

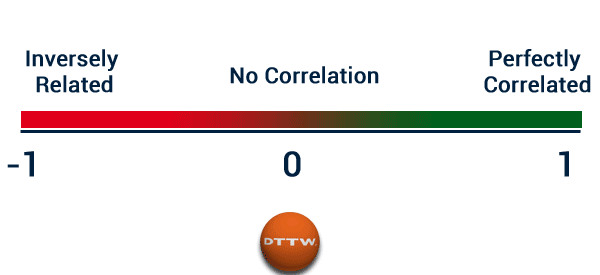

The other important thing you need to know when overtrading is on stocks correlation. In most periods, companies in the same industry tends to move in the same direction. Therefore, you should ensure that you know about this.

For example, if you open buy trades on stocks like Apple and Microsoft, chances are that you will make money when the shares rise. If technology stocks decline, there are chances that your trades will make a loss as well.

Summary

In this article, we have looked at the concept of overtrading and why you should avoid it. We have also looked at the risks of this practice and when you should open numerous trades in a given day. In all, we recommend that you open a few trades per day instead of hundreds.