Market Begs: Tell Us Something Good!

We compiled a list of the 10 biggest uncertainties in the stock market right now.

In no particular order:

China-trade wars and chip wars Oil and food inflation Strikes Government shutdown Corporate and individual bankruptcies on the rise Commercial real estate and banking Fed rates higher for longer Political polarization Social Unrest: how far can folks be pushed economically Geopolitical concerns: Russia and how far they will goWhat we do know is that the market is not a big fan of uncertainty.

Hence, until there is some glimmer of hope, we expect fear to prevail.

That leads us to speculate on where hope might come from.

In 2011, the government shut down. By October 2011, the market bottomed along with TLT (yields began to soften.)

Oil was at $100 a barrel and in 2012 fell to $80.

The accommodative Fed helped save the day. Plus, oil had very different fundamentals than today.

Now though, with $33 trillion in debt and rising inflation, if the Fed softens, it will help commodities prices and drive the economy towards stagflation.

We speculate that the dollar could fall as well.

In 2011 the Fed had wiggle room and much less of a debt issue. Now, not so much.

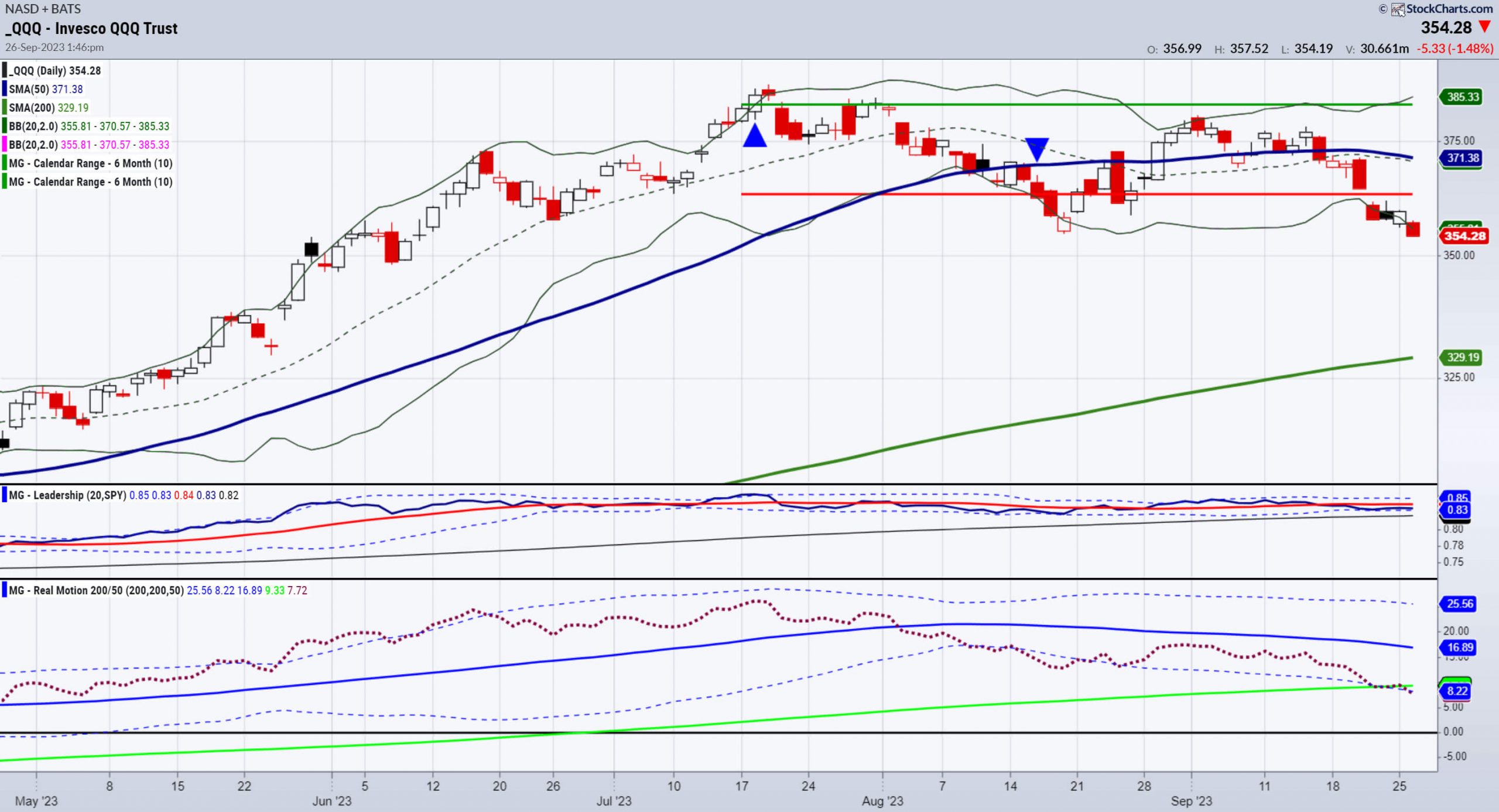

We show the NASDAQ chart as this is most likely where hope can emerge from.

Can AI and tech help efficiency while soothing the ailments of the day?

Over the weekend, we looked at volatility, retail, and small caps and came up with this as the Bottom line:

"A move over 18.00 or the 200-DMA in VIX, coupled with more downside pressure in IWM and XRT (watch momentum), could spell another leg lower-perhaps to 170 in IWM and 57 in XRT. Then, we look at the monthly charts and our 80-month moving averages on both, which have held since the heart of COVID."

Volatility cleared 18. Neither XRT nor IWM have hit the levels mentioned on the monthly chart yet.

Looking at the NASDAQ or QQQ chart, thus far, it is the only index holding the August lows.

It is neck and neck in performance to SPY.

Momentum continues to have negative or bearish divergence as QQQ is now under the 200-DMA in real motion while still well above in price.

Where does hope come from?

The charts will tell us.

Should we reach a nadir of support in XRT, IWM, and QQQs, buyers will come back. (The market is oversold).

However, oversold can get more oversold, so right now, the precipice still stares investors in the face.

This is for educational purposes only. Trading comes with risk.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com.

"I grew my money tree and so can you!" - Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Preparing for the Next Move in Equities and Commodities in this video with Benzinga's team.

Mish talks about the Head and Shoulders Top Pattern for the S&P 500 in The Final Bar.

Mish Covers sectors from the Economic Family, oil, and risk in this Yahoo! Finance video.

Coming Up:

September 29 Live Coaching

October 2 Schwab The Watch List

October 4 Jim Puplava Financial Sense

October 5 Yahoo Finance

October 12 Dale Pinkert F.A.C.E.

October 26 Schwab at the NYSE

October 27 Live in Studio with Charles Payne Fox

October 29-31 The Money Show

Weekly: Business First AM, CMC Markets

ETF Summary

S&P 500 (SPY) There are multiple timeframe support levels around 420–415 Russell 2000 (IWM) 170 huge Dow (DIA) 334 support Nasdaq (QQQ) 330 possible if it can't get back above 365 Regional banks (KRE) 39.80 the July calendar range low Semiconductors (SMH) 133 the 200 DMA with 147 pivotal resistance Transportation (IYT) 225 next support Biotechnology (IBB) 125; if clears impressive Retail (XRT) 57 key supportMish Schneider

MarketGauge.com

Director of Trading Research and Education