Small Caps Join The Party — Here’s a Top Stock to Consider

The S&P 500 and the NASDAQ both reached an all-time high today boosted by a Tech-fueled rally amid AI-related names. Small-cap stocks also had a bullish day after posting a two-month base breakout to near-term highs. This index has had a tough period recently, as nearly 15% of its stocks are in the Regional Bank group, which is down 9.5% year-to-date. Relatively high interest rates have also hurt, amid higher borrowing costs which lowered the growth outlooks for many of these smaller companies.

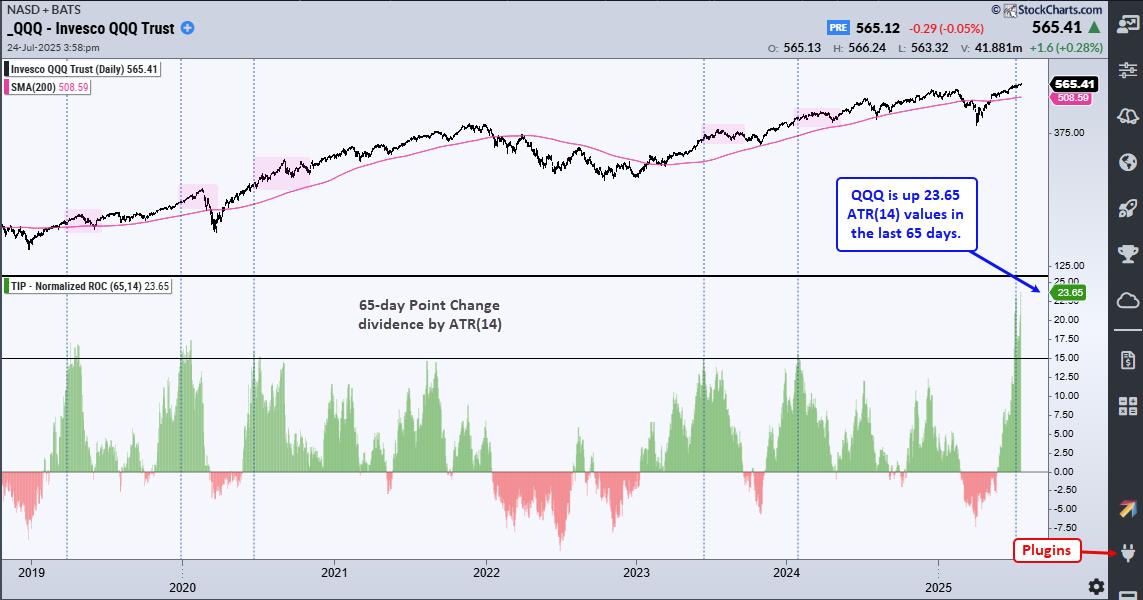

Daily Chart of Russell 2000 Small Cap Index (IWM)

Renewed interest in Biotech stocks is one reason for the recent rally in the Russell 2000 Index. This group accounts for 25% of this index, and positive clinical trials, coupled with the anticipation of more mergers of Biotechs with Large Cap Pharmas, has fueled the interest.

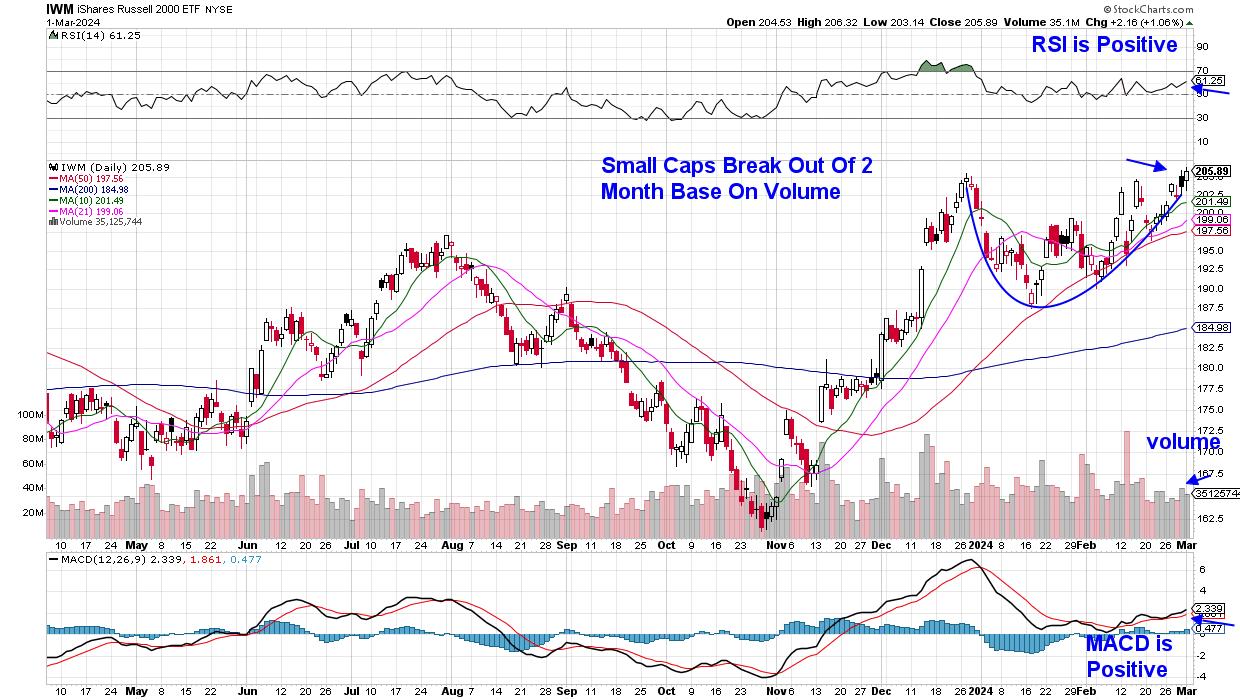

Gains in AI-related stocks have also contributed, led by Super Micro Computer (SMCI), which has exploded over the last 2 months. Below is the chart of another noteworthy small-cap tech company - CommVault Systems (CVLT).

Daily Chart of CommVault Systems (CVLT)

The provider of data protection systems, which helps companies recover from cyber attacks, posted one of their best quarterly results ever in late January after seeing subscription revenue gain 29% over last year. CVLT gapped up in price in response, and its four-week period of consolidation has allowed the stock to set up for another leg up.

Small-cap stocks are inherently more volatile, however, so I'd suggest keeping a close eye on the RSI for any hints of more than just a small pullback. With my work, I tend to stick to larger-cap names that can attract institutional money, which can help lead to outsized gains. In fact, my MEM Edge Report identified 4 of the top 5 year-to-date winners in the S&P 500. In addition to adding them to my Suggested Holdings List in November, subscribers were alerted to precise buy points on any pullbacks.

These four outperformers have gains ranging from 34% to 66% over the past 2 months, and they are a part of the twenty other cultivated stocks from my report that are poised to continue to outperform these upward-trending markets.

My twice-weekly MEM Edge Report also provides in-depth information regarding sector rotation and broader market trends. Be sure and use this link here to access a four-week trial at a nominal fee. You'll also have immediate access to prior reports that explain why these winning stocks are trading higher and how to uncover precise buy points.

Warmly,

Mary Ellen McGonagle

MEM Investment Research