DP Trading Room: Use a Price Momentum Oscillator (PMO) Sort to Find Winners!

Today Carl and Erin open the show with an example of how you can find stock and ETF relative strength using a Price Momentum Oscillator (PMO) sort. Many may not know but PMO readings can be compared to one another to determine relative strength.

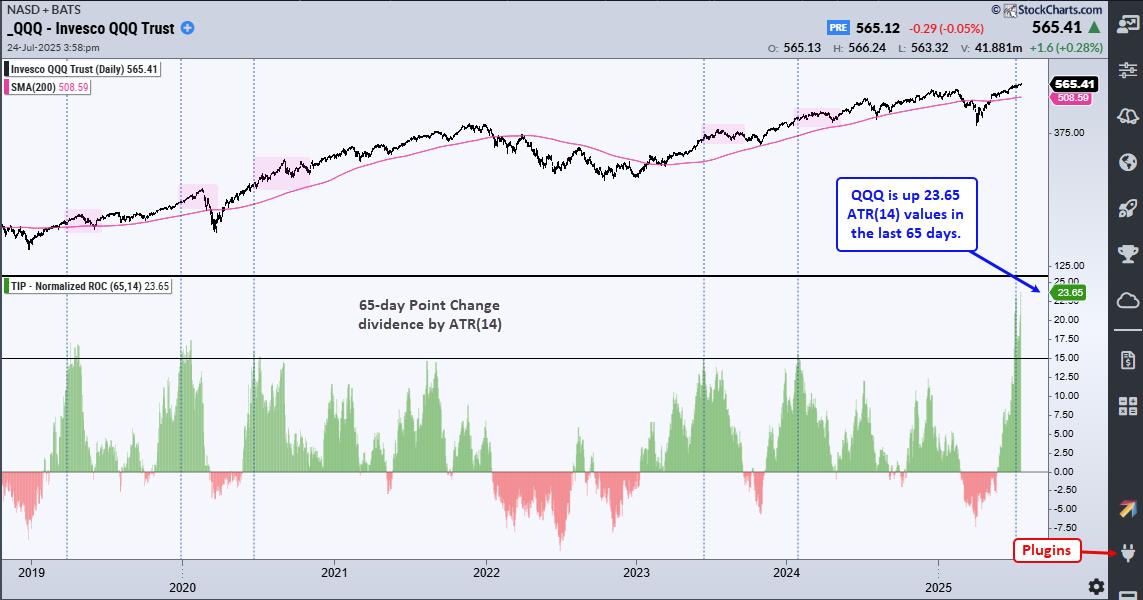

Carl gives us a review of the Magnificent 7 and looks at the market in general covering everything from yields to the indexes. Erin takes us on trip through the sectors and finds new strength in Comm Services with weakness still visible in Technology.

They finish the show with your symbol requests.

00:48 PMO Sorting

03:47 Magnificent 7 Review

07:42 Market Analysis

22:50 Questions Answered

27:30 Sector Overview

36:43 Symbol Requests

Watch the latest episode of the DecisionPointTrading Room on DP's YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)